How to Check How Many Saves You Have on Instagram

Open B9 Account in minutes

No credit checks

No minimum balance

Fully online

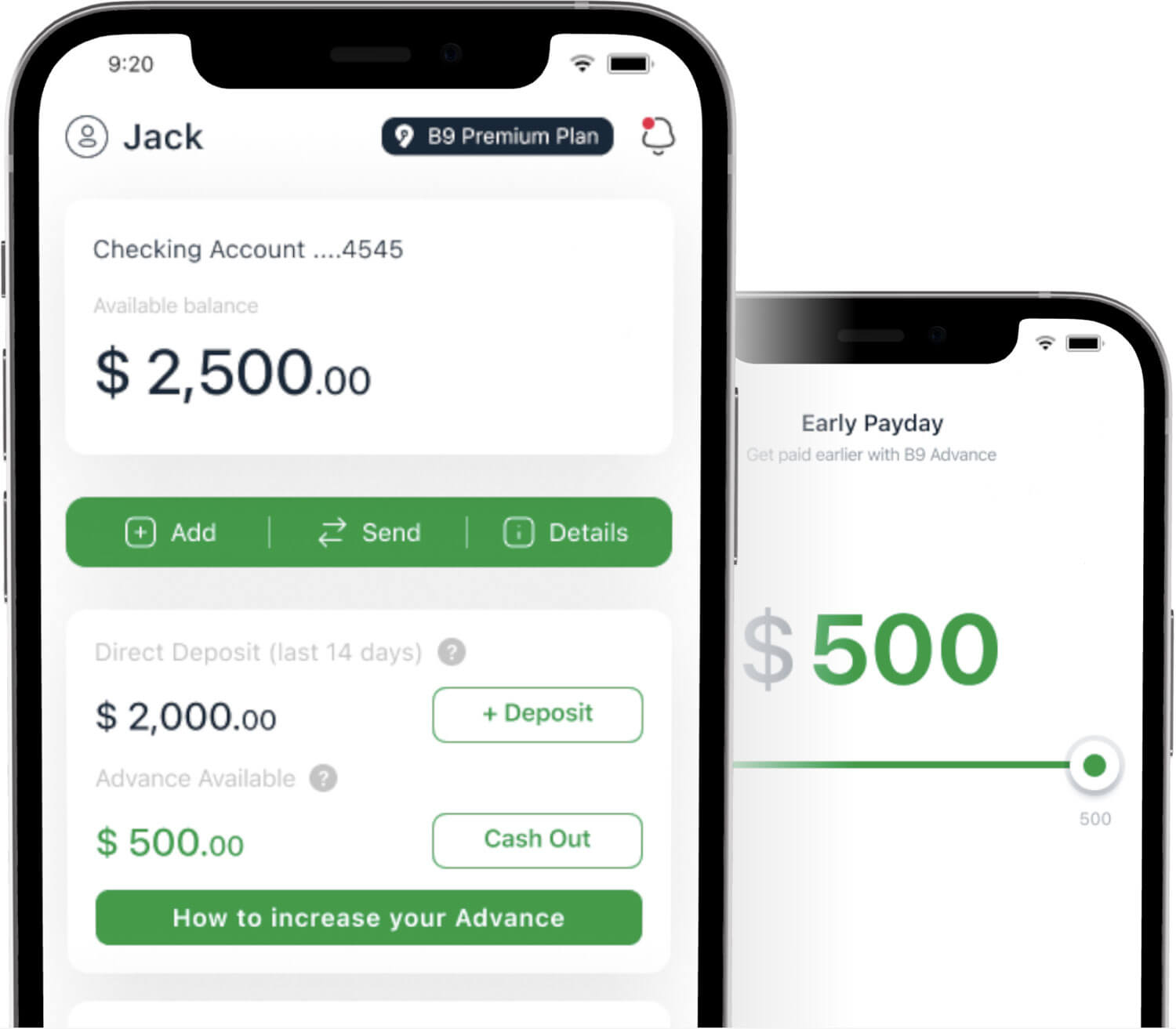

Everyday banking with B9 Mobile App

B9 Visa® Card

Pay everywhere with B9 Visa® Card or withdrawn cash from ATM

B9 Advance

Get your paycheck up to 15 days early

Fee Free bank transfers

ACH and internal transfers fee fee for B9 Members

Easy to apply,

Easy to use

Both SSN or ITIN are accepted in order to open your B9 account. You can easily connect B9 to any payroll platform to set up your direct deposit with B9.

There is a small $4.99 a month subscription fee for a B9 account which includes a B9 Visa debit card. Open your online bank account in 5 minutes with no minimum balance required, Start making purchases online with your B9 virtual card which is assigned instantly. No overdraft fees, no minimum balance required. Get your B9 debit card now.

GET YOUR B9 VISA® DEBIT CARD

Everyday banking with

NO credit checks,

NO minimum balance,

NO overdraft fees.

![]()

Only need

SSN or ITIN!

SSN & ITIN are accepted to open B9 Account.

![]()

Instant

cash

Instant transfers between B9 members.

![]()

B9 Visa®

Card

Pay everywhere with your B9 Visa® Card or withdraw cash from ATM.

kurbside

B9 is grrrrreat i really like this service and thanks B9 your the coolest awsomest app ever thanks so much be safe guys and god bless america give B9 a try seriously its grrrrrrrrrrrrreat

Dino Nunes

This is a fantastic card and they advance on your pay and every time you pay it back it goes up a little bit higher for the old grants even more money it's a great great service very happy I won't go anywhere else

Menterro Hambrick

I just recently started using the service and it has exceeded my expectations!!! The features alone was worth switching over my full deposit.

Chris B

They gave me an advance when nobody else would. They also made it super easy to switch my direct deposit over. Extremely helpful customer service

T-Two

Your best friend in a pinch I really enjoyed the app and I really appreciate the loan out of nowhere when I really needed it although it could be a little more user-friendly and possibly have some alternative options for like adding more than one Bank account

Elizabeth Konkle

Fantastic service Enrollment was fast and easy. My direct deposit went through the same week, and I was immediately eligible to get an advance on my pay. The virtual card was useful while waiting in my card to arrive

Skye Allred

B9 is One of the best places to get your check deposited to and get an advance they give you almost 100% of your paycheck is convenient is well worth it

Matt Dominguez

B9 has been a great service, they have really came in clutch when I've needed funds asap! I tell all my friends and family about the service, and how they have to get enrolled to see for themselves. Thank you B9!!!!

Teresa Urbano

This is app is great for an advance I was able to get a cash advance by my 2nd direct deposit. I would definitely recommend this app never really had issues with it like other payroll advance app. And it also lets you repay them anytime it's GREAT!!!!

Concrete_Soul Hardbody_Spirit

Greatest choice I have made in a while when it comes to banking.B9 comes through when you need them most.I received services immediately.

Jennifer

I was skeptical at first about the advances but it's great and easy to pay back. I also thought I wouldn't get paid 2 days early anymore but I do! I love my b9 account

John Hardy Sr

Great Experience and will continue to Use!!!! Everything is real and legit. Deposit are on time which usually is two days early and the advances really does help in a time of need. THANKS B9!!!

GENERAL FREQUENTLY ASKING QUESTIONS ABOUT BANKING AND ADVANCES

What is a beneficiary on a bank account?

The beneficiary is the person on Payable on a Death or POD bank account. This means that when the owner passes away, his/her heir has a right to use his assets, but only after that. The recipient�s right become as if s/he is an owner, which means that all the transactions, such as deposits, withdrawals, and so on, are now available to him/her. It can also be very convenient if the person that died had any unpaid debts. In such cases, the beneficiary can pay them off with the bank account of the passed away one.

What happens if someone has your bank account number?

Just having your bank account number doesn�t give a person any rights on it. But in combination with your routing and driver�s license numbers, address, and other information, the person can pretty much do everything as you can. Make sure not to give this information out to those who are not trustworthy enough, and be cautious about frauds that can call you and start asking for personal data. Save your bank�s number on your phone so that you will not confuse it with others.

How to close us bank account?

To close a US bank account can seem to be a difficult task. However, if you do everything right, it would not be daunting at all. First of all, you need to open a new account in another bank and transfer your finances and automatic payments to a new account. Afterward, close your old account. It is simple, just call the bank or go to a local branch. The whole procedure should not take more than 30 minutes. Some banks even allow closing an account online. When you finished, it is necessary to ask written statement from the bank that confirms that your account is closed.

What happens when a bank closes your account?

When closing a client�s account, the bank must return all the money from it to the owner. There are no existing reasons that can allow the bank to hold on to your money. They can only subtract the sum of your debts if these are present. You can also reopen your account after some time of inactivity on it or by paying your debts. If they noticed some unusual activity, which you are sure didn�t take place, ask them to reopen it again. The only time when you cannot reopen your account is when the bank is closing itself.

How to find a bank by account number?

If you are trying to answer the question of how you can find the bank using your account number, the answer might not satisfy you. Unfortunately, an account number is hardly useful when it comes to identifying the bank where it was opened. To find out to which bank a certain bank account belongs, you should rather use a routing number. A routing number is the raw of digits, usually placed right before the account number. It helps to find out where the bank is located and to which financial institution the account belongs. Not to confuse these two types of numbers, you can use the following hint: check which number is a couple of digits longer. The shorter one is the one you are interested in.

How to calculate bank interest on a savings account?

There are plenty of calculators of interest on saving bank accounts on the Internet that can help you to avoid complicated computations. By the way, visit the website of your bank because often they offer clients to calculate interests on their pages. The main principle of calculation is that your first deposit will grow at a certain speed, depending on the rate of interest. It means that you should multiply your deposit by the interest rate and period you are interested in. In the case of compound saving accounts, you should take into consideration the fact that an amount on the account will grow, and the profit will increase every day.

What can someone do with your bank account number and routing number?

In the era when almost everyone has a bank account, a lot of purchases and other financial operations involve a bank account number and routing number. Many people hesitate to give up this information because they are afraid that they can become victims of fraudsters. But the question is, what, in fact, can be done to you if someone gets access to this data? We can start with the good news, and it is almost impossible to hack your online banking service using this information. However, you can still lose money through unauthorized transfer or become a victim of ACH fraud because these operations could be easily done with your bank account number and routing number.

What happens when you close a bank account?

When a client closes its bank account, the bank itself would want to see a zero balance on it in order to escape any unnecessary complaints from the side of its customers. However, if you decide to close it before withdrawing all the money, then you can later take it back or transfer them. But in this case, the bank might subtract a certain amount of money from it for the continuing storage of your assets. Before closing your account, also check the conditions under which the bank will allow you to do it.

How to transfer a gift card balance to bank account?

Unfortunately, it is not possible to withdraw or cash out the gift card. The purpose of a gift card is to allow people to choose and buy products from the shop. Of course, there are ways to cash out gift cards; first of all, you can sell them, but you have to take a small discount on the price, not sell them at face value, to interest the buyer. Gift cards can also be exchanged. Let's say you were gifted a card to a cosmetics shop and you need a tracksuit. Now a lot of online sites where you can make a sale or exchange. So feel free to try different options.

How to close a bank account?

You can do it even without leaving your house. Often this can be done online or by calling the bank; only in some cases, your personal presence at the branch is required. Nevertheless, be sure to prepare your account for closure. Create a new one and connect all automatic payments to it. Move the remaining funds to a new account or take cash. It is also worth remembering that the bank will not close an account that has even the slightest debt.

How to open a bank account for a minor?

As a rule, banks do not allow minors to create a bank account without an adult�s involvement. In most cases, a joint owner is represented by the child�s parent or guardian. Once you have decided to develop the kid�s financial habits, specify the exact procedure you need to go through. Some banks will require visiting a local branch in person; others (modern ones) will ask you to install their app and fill out an online application form. You will have to prepare a documentation package including your SSN, driver�s license (or passport), your child�s birth certificate, or school ID (contact a bank representative over the phone for more precise information). In most cases, after you complete the application process, you have to deposit a certain amount of money into the new account. If it is not a custodial account and the kid has access to it, the bank will issue a card that the child can use to make purchases and manage funds at an ATM.

How much money can you have in a bank account?

There is no limit on the amount of money kept when it comes to a usual bank account. But you should notice that the insurance amount is only 250 thousand dollars, and keeping more than that on one account can be dangerous. In case when huge sums of money are needed to be kept, consider creating multiple bank accounts. There are no restrictions on the number of accounts or banks in which you can create them. If we are talking about a savings account, look for the one with the biggest interest for you.

Free download for iOS and Android

No extra apps needed to move your funds

Legal

Contacting B9 Customer Support

B9's Customer Success Team is here to help you when you need us!

For faster assistance, our FAQ has answers for our most frequently asked questions and is available to you 24/7.

In-App Support

Our Agents are available for B9 members via in-app support tab:

Mon-Fri: 5 AM to 9 PM Pacific Standard Time (8 AM to 12 AM Eastern Standard Time)

Sat-Sun: 6 AM to 6 PM Pacific Standard Time (9 AM to 9 PM Eastern Standard Time)

Email Us You may email us at support@bnine.com, one of our friendly Customer Success Team members will answer in 24-48 hours.

For additional support you may phone us by clicking on the FAQ for our hours of availability.

Complaints

Banking services are provided by Mbanq banking partners, Members FDIC. To report a complaint relating to banking services, email compliance@mbanq.com

- ✅ How to check who visited your account on instagram

- ✅ Open a bank account with B9!

- ✅ How to check who visited your account on instagram - Bnine

How to check who visited my facebook account

Pay everywhere with your B9 Visa® Card or withdraw cash from ATM.

How to check who visited my instagram account

Both SSN or ITIN are accepted in order to open your B9 account. You can easily connect B9 to any payroll platform to set up your direct deposit with B9.

How to check whos looking at your facebook account

There is a small $9.99 a month subscription fee for a B9 account which includes a B9 Visa debit card. Open your online bank account in 5 minutes with no minimum balance required, Start making purchases online with your B9 virtual card which is assigned instantly.

How to check whose bank account number

No overdraft fees, no minimum balance required. Get your B9 debit card now.

More account check 7 links

How to Check How Many Saves You Have on Instagram

Source: https://bnine.com/account-check-7/how-to-check-who-visited-your-account-on-instagram/

0 Response to "How to Check How Many Saves You Have on Instagram"

Post a Comment